By Sym Posey | The Birmingham Times

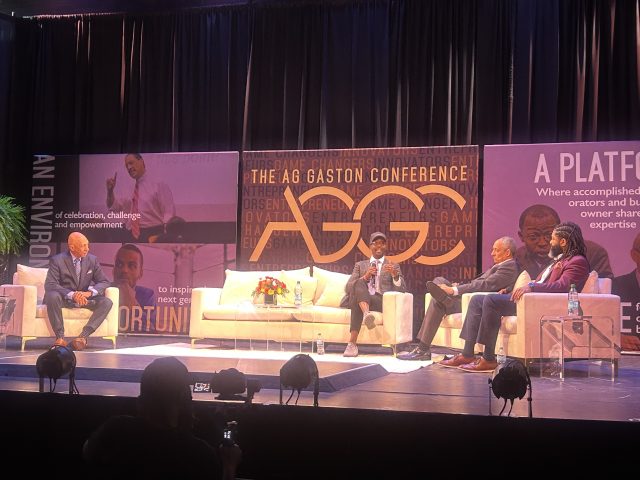

Business leaders, entrepreneurs, investors, and innovators filled Birmingham’s Red Mountain Theatre on Wednesday for the annual A.G. Gaston Conference under a theme of “Legacy, Leverage, and Liberation: Accumulating Assets That Lead to Wealth.”

The daylong conference served as a catalyst for empowerment, choice, and community transformation. The gathering held during Black History Month is named after Arthur George Gaston, who built a business empire during segregation, demonstrating that wealth is far more than a paycheck.

One of the many panel discussions focused on the difference between asset accumulation and wealth building.

The session was moderated by Birmingham Business Resource Center Executive Director Bob Dickerson and featured Dr. Anthony C. Hood, managing principal of Hood Allen Consulting; Isaac M. Cooper, founder and CEO of IMC Financial Consulting; and Stephen Glaude, president and CEO of The Coalition.

“Words do matter, and I think those distinctions between assets and wealth is important,” Hood said. “You can accumulate assets, but to the extent that those assets also are tied to liabilities… There are a lot of people in our communities with negative net worth. But on the outside, they appear to be moving toward wealth.”

He challenged attendees to examine how many “assets” — homes, businesses, investments — are heavily burdened by debt.

“I see a lot of potential assets in our community,” he added, “but how many of those assets are encumbered by liabilities?”

The panel emphasized that asset ownership without discretionary income or margin can create financial strain rather than freedom.

Social Media-Fueled Narratives

Cooper pointed to social media-fueled narratives that oversimplify entrepreneurship and wealth creation.

“There’s a lot of communication on TikTok and YouTube on what it takes to establish a business. Folks think if they start an EIN number, they’re going to be millionaires in 20 years … it just doesn’t work like that.”

He stressed that wealth begins with cash flow discipline.

“When you peel through what it says for you to have discretionary income… the expenses that go out do not need to outweigh the money that’s coming in. If there’s no money left over, the conversation of wealth doesn’t even need to be entertained,” he said.

The conversation turned personal as Hood reflected on the blue-collar Birmingham neighborhood where he was raised.

“In the last 30 years, we’re in a place now where people make $150,000, but they’re buying a $600,000 house,” he said. “Now we’re defined by the amount of house and what we make in a year.”

He contrasted that with earlier generations who purchased homes well below their annual income, building equity slowly and deliberately.

The consequences of today’s approach are visible to younger generations, he continued.

“A lot of teenagers don’t want to buy a house because they see the stress that a lot of adults are in right now,” Hood noted. “They don’t see that as independence. They see the stress.”

Glaude echoed that concern, warning that presenting leveraged assets as wealth risks erodes trust.

“What we need to do is sit with the discomfort,” Glaude said. “We’re trying to run past this. We’re trying to conclude this. We’re trying to say, ‘Look what we’ve done,’ and we actually could end up making things worse.”

AI And Workforce Development

Beyond household budgeting, the panel addressed a looming structural threat: artificial intelligence and workforce displacement.

Hood delivered perhaps the starkest warning of the afternoon.

“If you are listening to me right now, it’s a good chance that you are going to lose your job. It’s not coming. It’s already here.”

Referring to widespread corporate layoffs, he urged families to prepare for economic volatility.

“Make sure you have enough cushion — six months, nine months, 12 months, 18 months of savings,” he said. “If you were making $200,000 but you lived in an $800,000 house… that’s just not a good place to be.”

Technology is also altering people’s emotional relationship with money, Cooper added. The shift from cash to digital transactions has reduced the “friction” of spending, making it easier to overspend without feeling the impact, he said.

“The relationship with money is less — there’s less friction,” Cooper said. “Their ability to have a memory that is emotionally driven is tough.”

“Retrain Assets”

The panelists pushed beyond traditional financial literacy.

Glaude urged communities to “retrain assets as a valuable thing” while rejecting the fantasy of overnight wealth. Cooper expanded the framework to what he called a progression — from literacy to coaching, to assets accumulation, to investment management, and ultimately estate planning.

“The number one thing that we are missing as a community is estate planning,” Cooper said. “Why do all this work to accumulate so much and let the government get their hand in the pocket when you’re trying to pass it down?”

He reminded attendees that wealth transfer — not just wealth accumulation — defines long-term community stability.

“Every tax bracket has blind spots,” he added. “Financial literacy isn’t just for poor people.”

Underlying every point was a deeper theme: mindset. “If we don’t get the mind right,” Cooper said earlier in the discussion, “all of the know-how, the concepts, all of this different information — it won’t change your life.”

The panel closed on a note of cautious optimism. Glaude described the report behind the discussion as a “flare in the sky,” meant to slow society down long enough to examine what wealth truly requires.

“There’s something good in having the awareness,” Glaude said. “Maybe even a little bit of agitation to get it right.”

The A.G. Gaston Conference, founded by Dickerson and Gaynell Adams Jackson, has always been more than a tribute; it is a call to action. It is an annual reminder that true progress is forged through cooperation, education, and bold economic participation.