regions.com

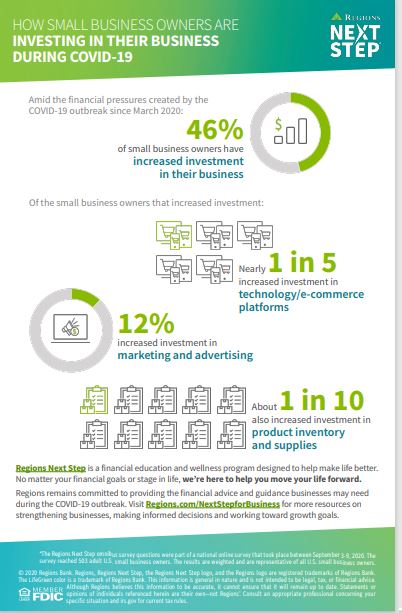

A new survey from Regions Next Step, Regions Bank’s financial education program, finds that nearly half of small business owners (46%) have invested more money in their business amid the financial pressures created by the COVID-19 outbreak.

Technology and e-commerce platforms are the leading areas of increased investment. Approximately 1 in 5 (18%) of small business owners increased investment and 38% of these businesses are within the finance, accounting, consulting and insurance industries. The survey, conducted in September of business owners with 100 employees or less, also shows that small business owners are investing more in marketing and advertising, as well as product inventory and supplies, with 12% of respondents increasing investment in these areas.

“With business success tied to the ability to withstand financial challenges, many business owners have had to adjust to this new environment” said Joye Hehn, Next Step financial education manager for Regions. “Reviewing the business’ financials within the current landscape can help in identifying ways to fine-tune operations and opportunities that could help propel the business forward.”

“Business owners continuously face important decisions on how to adapt their strategy,” said Jim Kersey, Regions consumer banking manager in Nashville and featured panelist in Regions’ upcoming webinar, Steering Your Business Toward Success in the “New Normal.” “Having and building a relationship with a trusted banker can help business owners navigate the complexity of the market and make informed financial decisions.”

The COVID-19 outbreak has caused disruptions to many small businesses. Below are tips on moving business forward during tough times:

- Keep strategic plans current. Whatever recovery looks like, having a good roadmap can help position a business for success. Listen to the podcast, COVID-19 Special Episode: How Can I Protect My Business?, for more on safeguarding businesses during this time.

- Invest in marketing: A smart marketing plan can help a business retain and gain new customers during this time and beyond. Consider these factors when ramping up promotion efforts.

- Adjust business processes. Many business owners have already made some changes out of necessity, such as switching from banking or working in-person, to using digital services. Learn about managing finances digitally and consider what processes can be improved.

- Stay informed of fraud schemes. Scams have emerged amid the confusion of the COVID-19 outbreak targeting businesses of all sizes. Learn more about COVID-19-specific scams in this article.

For more advice on navigating disruption in today’s environment, register to watch the Steering Your Business Toward Success in the “New Normal” webinar on November 10, featuring Kersey and Bobby Hoyt, the Millennial Money Man. The webinar will also be available on-demand after the live event.

Regions remains committed to providing the financial advice and guidance businesses may need during the COVID-19 outbreak. Visit Regions.com/NextStepforBusiness for more resources on strengthening businesses, making informed decisions and working toward growth goals.

The Regions Next Step omnibus survey questions were part of a national online survey that took place between September 3-9, 2020. The survey reached 503 adult U.S. small business owners. The results are weighted and are representative of all U.S. small business owners.